Stop leaving up to $500,000 in payroll tax savings on the table! Too many startups miss out on using R&D tax credits to reduce their payroll taxes. Let Earnd qualify, quantify and process the credits you’ve earned to unlock this immediate cash flow. This election MUST be made on your original income tax return. Contact Earnd today!

Companies are so busy building their business, R&D tax credits are often not on their radar. Too many companies leave money on the table not realizing they qualify for available R&D tax credits.

Earnd serves startups and more established companies by helping them get the credit they deserve for investing in R&D and by putting money back into their pockets. Earnd identifies and captures HIDDEN TREASURE!

And, you only pay for savings we identify.

Our founders bring an unmatched depth of experience to your business. Over the past 20 years, our team members have overseen the identification and collection of hundreds of millions of dollars in R&D tax credits and other savings for hundreds of companies.

Our experience spans tax credit accounting, consulting, finance, manufacturing, data analytics, software development, technology infrastructure and cybersecurity.

Our proprietary Innovation Acceleration Engine™ combines deep subject matter expertise with forensic technical analysis to uncover dollar-for-dollar reductions in tax payouts.

The protection of your data is our top priority. Our cybersecure technologies and processes are designed to mitigate risk and keep your data safe.

As your partner, we’ll manage the complex process of calculating your applicable tax credits and incentives as well as provide comprehensive technical and financial results of our study.

Innovation happens everywhere, from engineering workstations and factory floors to activities in the field and biolabs. Our tax credit specialists work with companies across a wide variety of industries who are innovators in their disciplines that invest capital upfront to drive innovation. Here are just a few of the industries we serve.

Federal and state governments encourage innovation by rewarding investments in research and development with tax credits that reduce the taxes you pay based on qualified expenses. Our experts can identify your eligibility and accurately predict your expected savings now, so you can get on with the business of innovation. These savings often include payroll tax credits plus other incentives and deductions.

First, we quickly determine if you qualify for R&D tax credits through a review of preliminary information. This step is as easy as answering a few simple questions.

Then, we request initial information to allow us to tailor the process to your needs. We collect data needed for calculations, preferably directly from your systems. To optimize value creation, we investigate broadly, weighing strategic considerations such as the potential audit review and other critical success factors.

Next, we collect documentation to facilitate compliance integrity to fully realize the tax credits you've earned. We prepare the requisite tax credit forms and retain technical and financial documentation, as well as proof of all Qualified Research Expenditures and any expenses required for other credits and incentives.

Working together, we can supply any of your other trusted partners - from your payroll provider to your CPA - with the information necessary to apply your tax credit accurately against your payroll or income taxes.

And as tax credit, workforce stimuli, incentive and deduction laws and requirements change over time, we help you stay in compliance. We're also here when you need us, long after the first engagement.

At Earnd, we believe innovation is a heroic endeavor. It takes vision, passion and persistence to truly make an impact. It’s why we celebrate those who have strived to find a better way.

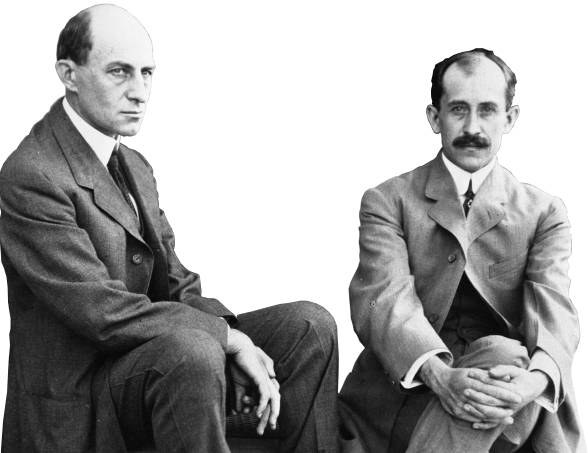

Beginning their careers as publishers and bicycle manufacturers, Orville and Wilbur Wright invented, built and flew the first motor-operated airplane after studying the flight of birds and conducting countless experiments with ordinary materials. Their key breakthrough was the creation of a three-axis control system which enabled a pilot to steer the aircraft and maintain equilibrium – a system that is still used today. The brothers also developed a home-built wind tunnel to test the control system. Their first US patent was for a system of aerodynamic control that manipulated a flying machine’s surfaces.

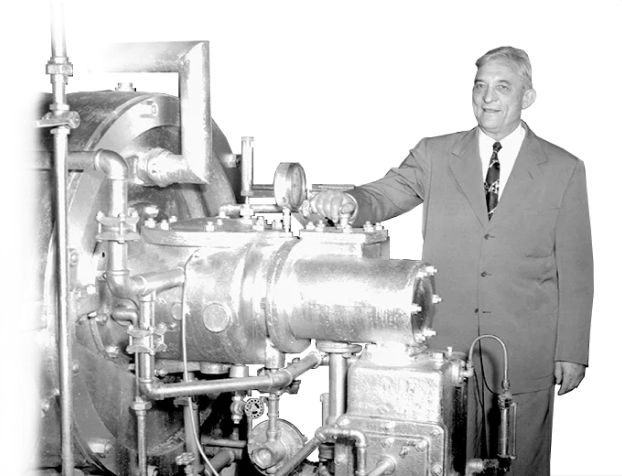

An American engineer and inventor, Willis Carrier developed the first machine capable of cooling air using a non-toxic and non-flammable refrigerant. In 1902, he added a mechanism to control the humidity. This unit was the world’s first air conditioner. In 1915, he founded Carrier Engineering Corporation to sell air conditioning systems.

The son of a shoemaker, Charlie Brannock grew up thinking about feet. As a young man, he became obsessed with figuring out the best way to measure one. The only way to figure out your size at the time was with a wooden block, a method that didn’t work very well. While attending Syracuse University, he set out to solve the problem using a toy construction set to build a prototype of a device that accurately measured foot sizes. With sales in the millions, the Brannock device has become a staple for shoe stores all over the world.

Margaret Knight was working in a paper bag factory when she noticed how difficult it was to pack things into the flimsy, shapeless sacks. She invented a machine that folded and glued paper to make a flat-bottomed bag. Knight spent late nights drawing up plans before creating a wooden prototype of the machine. She couldn’t, however, obtain a patent until she made one out of iron. While it was being produced, an employee named Charles Annan copied her idea and got a patent for it. Knight sued Annan for copyright infringement. Her sketches and detailed plans won her the case. Knight ended up establishing her own paper bag company and received large sums of royalties for her invention.

A native of Budapest, Biro made his living in journalism. One day he noticed that printer ink dried faster and made fewer blots than conventional ink. Biro decided to use it for his fountain pen. This attempt failed – the paint was too thick. After much experimentation, he came up with a ball head, which rotated and evenly distributed the ink on the paper. The invention was patented in 1938, and seven years later, Marcel Bich bought the patent and made the ballpoint pen under the trademark name Bic.